| Daily Commentary |

|---|

|

|

|

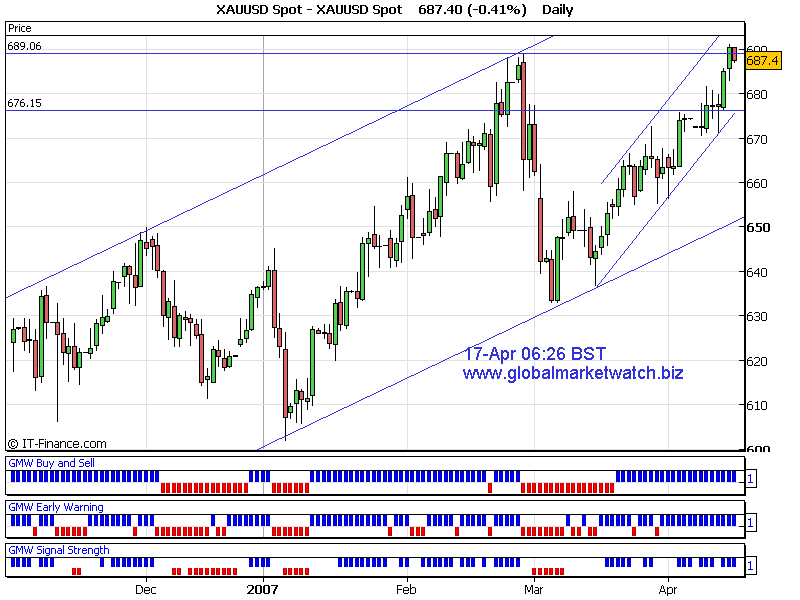

Gold dipped to anticipated short term support around 682 and reversed back to anticipated short term resistance around 691. Based on some technical indicators, I still believe that 688~691 area is posing as a potential selling zone. Although daily trend indicators are strong up, short term indicators are starting to show a weakness at current price. Current near term support will be around 687 and strong resistance area would be at 691. Short/Medium term support will be around 679 and resistance will be at 696. Current trend is neutral at the time of analysis. Key levels to watch are 687~686 to downside and 691 to upside. Possible downside target can be around 679~676 and upside target would be around 696 if near term support and resistance levels are violated. P.s. If you are looking for US stock, forex and futures charts, opinions and quotes, you can visit our main website here. There are also some educational materials about futures and option tradings. (Choose "Futures 101" from "Select" box) Good Luck! Thanks for listening! Gold Trader

p.s We are arranging to give away some classic Robert Prechter's Elliott Wave Principle Books. More information will be posted on our main website soon. |

|

|

I have also posted the signals on my main web site in the individual chart page. For subscription based analysis sample, you can find it in "Samples" page of my main website. For Elliott Wave International's Commentary, please visit here! Trading Platform to trade gold, silver and forex => Click Here |

|

|

|